nebraska property tax calculator

Sarpy County real estate taxes are levied in arrears. If you make 70000 a year living in the region of Nebraska USA you will be taxed 12680.

Nebraska Sales Tax Small Business Guide Truic

County AssessorDeputy Assessor Examination - November 10 2022.

. Nebraska is ranked number seventeen out. See Property Records Deeds Owner Info Much More. The Nebraska Department of Revenue DOR has created a GovDelivery subscription category called Nebraska Property Tax Credit Click here to learn more about this free subscription.

Unsure Of The Value Of Your Property. See Property Records Deeds Liens Mortgage Much More. Nebraskas state income tax system is similar to the federal system.

Nebraska Salary Tax Calculator for the Tax Year 202223. Important note on the salary paycheck calculator. Ad See If You Qualify For IRS Fresh Start Program.

The median property tax in Lincoln County Nebraska is 1924 per year for a home worth the median value of 109100. You are able to use our Nebraska State Tax Calculator to calculate your total tax costs in the tax year 202223. The state income tax rate in Nebraska is progressive and ranges from 246 to 684 while federal income tax rates range from 10 to 37 depending on your income.

Find All The Record Information You Need Here. Analysis from Leading Practitioners and the Resources You Need to Make Informed Decisions. Nebraska Income Tax Calculator 2021.

Simply close the closing date with. For comparison the median home value in Nebraska is. The median property tax in Nebraska is 176 of a propertys assesed fair market value as property tax per year.

For comparison the median home value in Lincoln. Your average tax rate is 1198 and your marginal. Ad Enter Any Address Receive a Comprehensive Property Report.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Ad Be the First to Know when Nebraska Tax Developments Impact Your Business or Clients. Tax amount varies by county.

The tool helps residents calculate the new refundable income tax credit available this year that allows. Education Certification Advisory Board Meeting - August 29 2022. About Your Property Taxes.

Nebraska school district property tax look-up. Counties in Nebraska collect an average of 176 of a propertys assesed fair. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

Lincoln County collects on average 176 of a propertys assessed. This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our Nebraska property tax records tool to get more. Its a progressive system which means that taxpayers who earn more pay higher taxes.

Based On Circumstances You May Already Qualify For Tax Relief. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. For example the 2020 taxes are levied at the end of 2020 and become due on the last day of December.

Lookup An Address 2. Search Any Address 2. The median property tax in Nebraska is 216400 per year for a home worth the median value of 12330000.

See Results in Minutes. There are four tax brackets in. Free Case Review Begin Online.

This proration calculator should be useful for annual quarterly and semi-annual property tax proration at settlement calendar fiscal year.

State Corporate Income Tax Rates And Brackets Tax Foundation

Nebraska Property Tax Calculator Smartasset

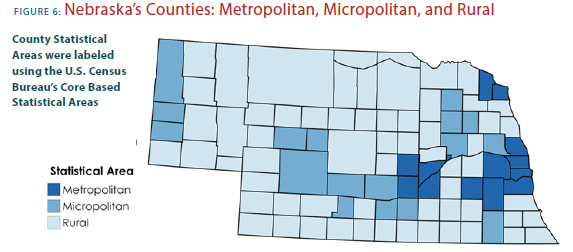

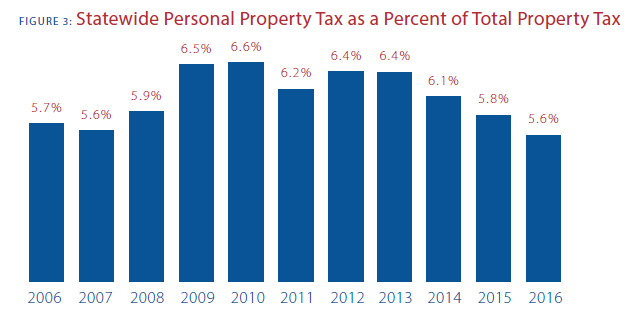

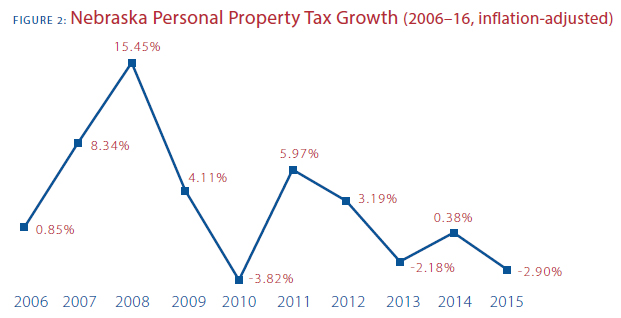

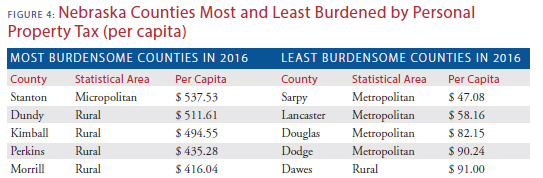

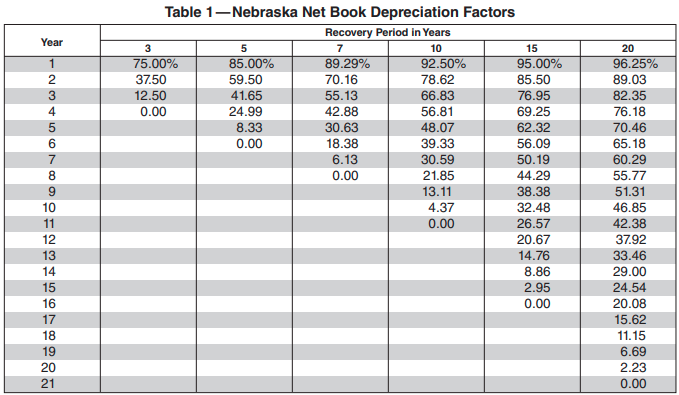

This Time It S Personal Nebraska S Personal Property Tax

Nebraska Property Tax Calculator Smartasset

Don T Die In Nebraska How The County Inheritance Tax Works

2022 Property Taxes By State Report Propertyshark

Hennepin County Mn Property Tax Calculator Smartasset

This Time It S Personal Nebraska S Personal Property Tax

This Time It S Personal Nebraska S Personal Property Tax

2020 Nebraska Property Tax Issues Agricultural Economics

States With The Highest And Lowest Property Taxes Home Sweet Homes

Get The Facts About Nebraska S High Tax Burden

General Fund Receipts Nebraska Department Of Revenue

This Time It S Personal Nebraska S Personal Property Tax

Omaha Property Taxes Explained 2022

About Nebraska Personal Property

Taxes And Spending In Nebraska

Refundable Income Tax Credit For Property Taxes Paid To Schools Nebraska Farm Bureau